We’re Not Giving Up.

Congress should pass the CHIPS for America Act. But more must be done.

Since the beginning of March, we have been working hard to make sure our priorities, like making Trade Adjustment Assistance (TAA) and the Health Coverage Tax Credit (HCTC) permanent., the Supply Chain Resiliency Act, and the Leveling the Playing Field Act 2.0, remained intact in the final COMPETES bill. Thousands of USW members made calls, sent emails and letters, visited offices, and educated one another on why we need to stand up for a manufacturing plan that put workers first. We thank you for that.

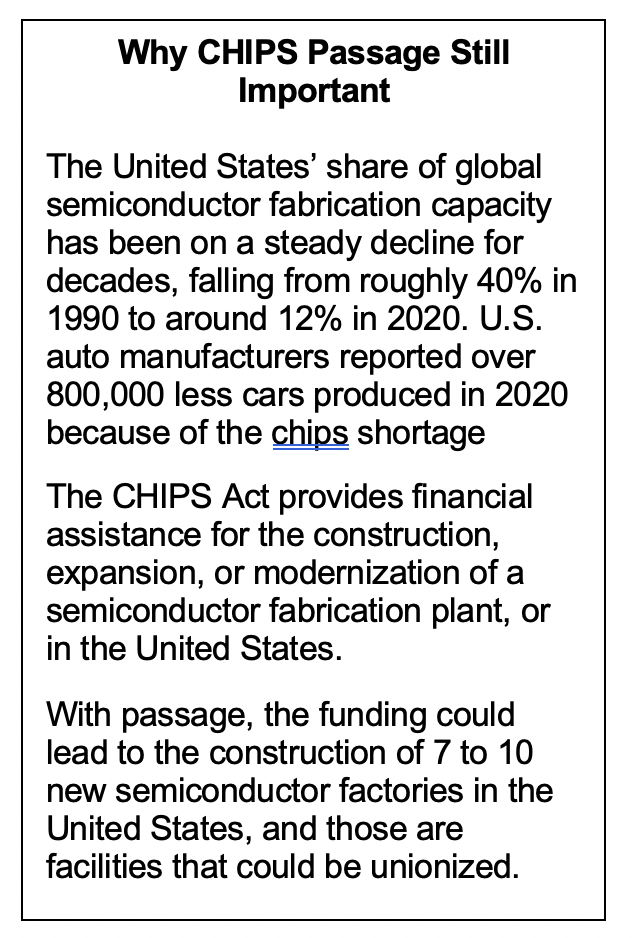

It is becoming clear the final bill, the CHIPS for America Act, short for the Creating Helpful Incentives to Produce Semiconductors for America Act, would designate $52 billion in subsidies and offer an investment tax credit to encourage semiconductor companies to boost manufacturing in the U.S.

We have all seen the supply chain crisis from this industry, and know that when we invest in ourselves workers win, so we fully support it. We expect a final passage in the Senate possibly today, with the House will likely taking the bill up this week.

But we want and need more from Congress.

On June 30, Trade Adjustment Assistance (TAA) was allowed to expire. Until Congress reinstates the program, the Labor Department cannot consider any additional petitions for TAA assistance. This means the 900 steelworkers at U.S. Steel’s Granite City, Ill., Works will not have the security of the program to help them train into new jobs. Those siblings are not alone, thousands more will not be eligible for the only real defense against the damage inflicted by poor trade policies. In 2021 alone, the Department of Labor certified 801 petitions for trade adjustment assistance from various workplaces, covering an estimated 107,454 American workers. Already 4,500 workers have missed out on the programs’ benefits since it lapsed, a number that is expected to quickly grow.

We want Congress not just to continue the program, but to expand and strengthen it. We want enhancements like:

- Streamlining the application process;

- Providing a tax credit for child care;

- Coverage for workers who lose their jobs when foreign countries restrict imports of U.S.-made goods;

- Extension of TAA to public service workers who lose their jobs when illegal dumping forces a local facility to close, decimating the community’s tax base.

We are not giving up on our priorities. It has been seven years since Congress updated our trade enforcement laws and although the CHIPS for America Act will help, there is so much more to be done.

Click HERE for a printable version to distribute in your workplace.

If you are unable to open it properly, please try another browser.

(412) 562-2291 http://www.uswrr.org